When you plan to live alone for the first time, you might be overwhelmed by the related household expenses that you will be spending, including food, utilities, and rent.

While you are looking ahead to a pleasant experience living in your Branson apartment, it's important for you to learn basic budgeting and ways you can make it easier. Here are some easy tips that you can use to lower your budget and help you become comfortable in your new living space.

How to Start Your Budget

When you start budgeting for Branson apartment living, you need to calculate your monthly income and then calculate your monthly expenses. When you subtract your expenses from your income, then you will see how much money is left. Try calculating your monthly expenses and see how much you have leftover to budget for your living expenses.

If it's your first time living alone without any financial help, then you need to adjust your expectations and the financial numbers to make it realistic. You will likely have to deal with bigger expenses now, than when you were in college or while living with your parents, so you have to give your best estimates for what you'll be spending on each item. For example, you will need to estimate and calculate how much money you'll spend on groceries, utilities, entertainment, and insurance.

You need to modify your budget so it can reflect your living expenses. You can change it after paying a few months' expenses and have compared your actual spending to the budget.

How to Account for Living Expenses

When you can find an apartment that includes utilities in the rent, it can help simplify your budget, but this option isn't always offered. If electricity, gas, and water are not included in the rent, you will need to factor them, along with other common expenses, into your apartment budget as follows:

· Rent – This amount is fixed each month for the duration of your rental contract.

· Electric – Tenants typically pay for electric bills. If you’re living in a Branson apartment, your electric bill should typically be smaller each month, in comparison with a home or a more extreme climate.

· Natural Gas – Gas is often paid for by the landlord. However, if you shoulder this utility, make sure you can make the monthly payments, as the utility company can easily turn off your heat and hot water for the money owed.

· Water-Water bill is sometimes included in the rent however, many rental properties will require you to pay for this utility.

· Internet and Cable – Nearly all renters are responsible for this bill. You can get a bundled service from your cell phone or cable provider at lower rates. Depending on your apartment complex, you may be required to pay an installation fee.

· Renter's Insurance – This insurance will cover all of your belongings in your apartment in case of theft or damage.

You need to be aware of these common fees that many landlords charge, such as pet fees, garbage pickup, pest control, parking, storage/garage, and administration fees. Not all apartments come with these fees, however it’s a good idea to ask if the property you are considering moving into does. Some fees could be collected monthly, while others may be paid one-time.

Security Deposits

Besides paying the rent for the first month, you will likely need to pay security deposits equivalent to a minimum of one month's rent.

Renter's Insurance

Many rental companies require you to have proof of insurance before you move in, which is a good idea to ensure your belongings are protected. Renter's insurance usually costs around $10 to $20 a month, depending on the area you live in and your apartment type.

Utility Deposits

Most rental companies will require that the utilities should be in your name. Therefore, the utility company will ask you to pay a deposit for service, especially if this is your first time paying for your own utilities. Deposits generally cost between $70 and $150, but you most likely will get a refund if you pay your utility bills on time. Ask your utility company what their particular policy is.

Administration Fees

When you apply for an apartment, the rental company will likely need to run your credit and conduct a background check before your application is approved and you are allowed to move in. You normally have to pay an administration fee for this service, although there are companies that will waive the fee if they have a special offer going on.

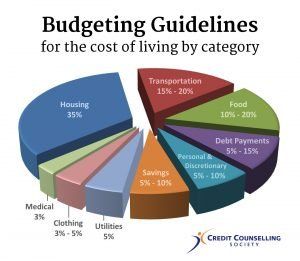

Deciding how to budget for your expenses while living in a Branson apartment can be a difficult task. You should consider all factors before deciding how much of your income will go to your rent and your other living expenses. The rule of thumb for rent dictates that you should spend no more than 30% of your income on housing each month.

If you would rather not worry about estimating all utility and housing expenses, consider Branson’s new apartment community - Branson Quarters! This new community offers Efficiencies, 1 & 2 Bedroom Apartments and ALL UTILITIES ARE INCLUDED!! Including Water, Electric, Trash, Cable and Internet. Call Thousand Hills Realty today at (417) 337-8081 to hear how to reserve your spot at Branson Quarters!